External Tax Engine Plugin

The custom tax engine plugin allows you to integrate external tax engine services of your choice that Centra does not support out of the box. It is intended to be used along with Checkout API or on the AMS side in case of manual order creation. The external custom tax calculator will be called in various order lifecycle points (e.g. pre-checkout, on checkout, on shipping, etc.) to receive proper tax rates and apply them to the selection or the order.

Setup

Please note that you are responsible for the proper external service architecture in case you choose to integrate the custom tax engine. It means that the service you build might be able to handle high load, autoscale, and/or use other techniques that will help to handle incoming traffic spikes.

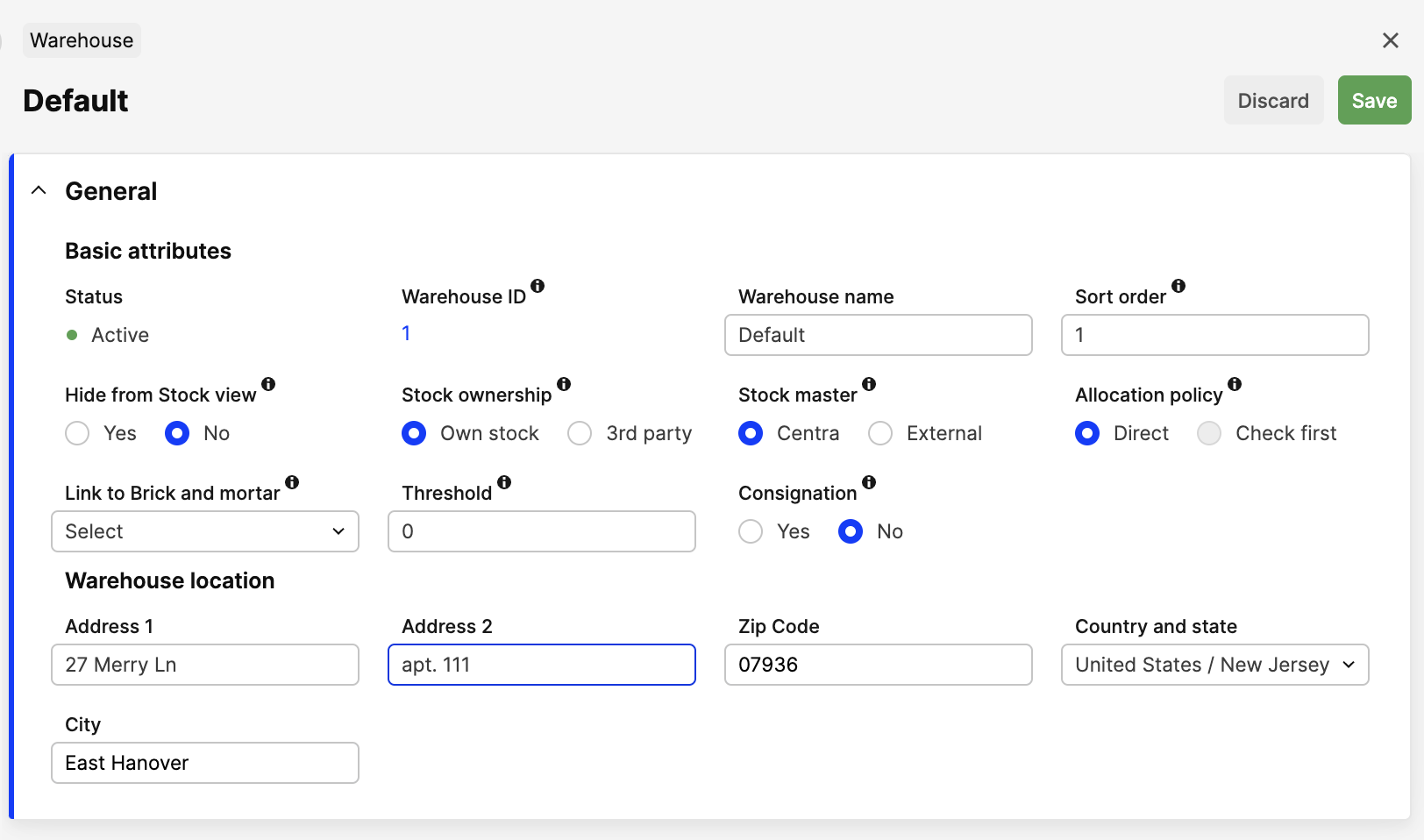

Warehouse address

To calculate taxes for some countries (e.g. US, Canada, etc.) there is a requirement to have a warehouse address filled in. You need to specify the full address of the warehouse to calculate the tax correctly. You can fill in this data on the specific warehouse page.

Plugin

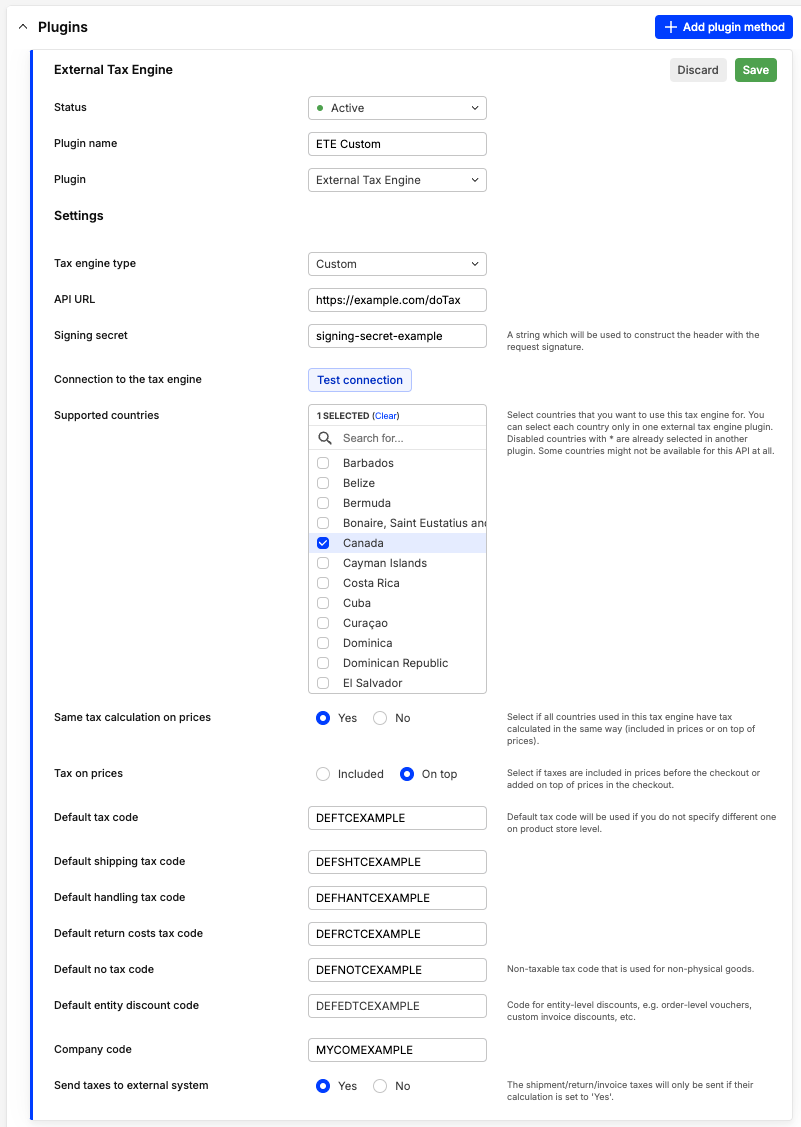

Here is a sample of a custom tax engine plugin setup:

To set up the External tax engine (ETE) plugin, you need to provide all the basic information:

Plugin name- the name used for some info displayed across the AMS (e.g. selectors, history entries)Tax engine type- should beCustomAPI URL- the endpoint Centra will send requests for tax calculation to.

Please note that this endpoint should be able to handle multiple types of payloads depending on the request type (see Request type concept).

Signing secret- the string which will be used to construct the request signature header to make it possible to verify the validity of the request on your ETE side (see Request signature concept).

You may see the plain value for the signing secret field on the plugin form, but don’t worry - we encrypt the field value on DB and store it safely.

Connection to the tax engine- here you may check the connection to the API you specified above. See Test connection to learn more about how the connection check works.Supported countries- there is a selector which defines the set of countries ETE should be called on. Order shipping address country selection triggers the check if ETE should be called, and calls it if the condition is fulfilled.Same tax calculation on prices- select if all countries used in this tax engine have tax calculated similarly (included in prices or on top of prices).Tax on prices- select if taxes are included in prices before the checkout or added on top of prices in the checkout.Default tax code- general fallback tax code will be sent on the basket line if you do not specify a different one on the product store level.Default shipping tax code- the shipping tax code will be sent on the basket line to calculate shipping costs' tax.Default handling tax code- the handling tax code will be sent on the basket line to calculate handling costs' tax.Default return costs tax code- the return costs tax code will be sent on the basket line to calculate return costs' tax.Default no tax code- the tax code for non-taxed non-physical goods, used for refunding the absolute money values including tax.Default entity discount code- the tax code for entity-level discounts, e.g. order-level vouchers, custom invoice discounts, etc.

There is no way to set non-default shipping, handling, return cost, entity discount and non-taxed codes for some specific entity - the configured default code will be used for calculations for all entities.

Send taxes to external system- if selected, Centra will make requests to ETE not only for the tax calculation but for tax filing purposes. Those calls will have a separate request type, so you will know for sure when exactly the tax should be filed.

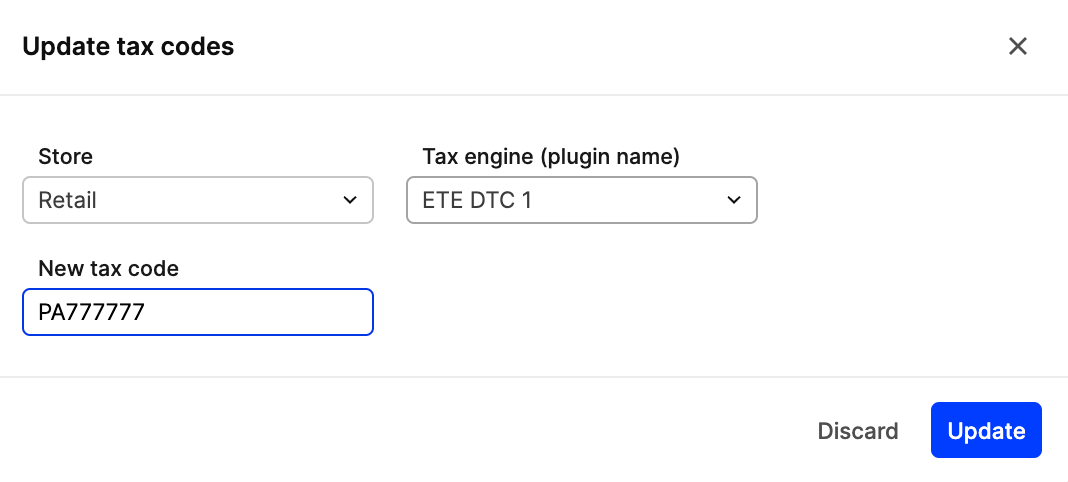

Tax code batch assignment

There is a possibility to do a mass assignment of tax codes for products on the product catalog page. It has the Update tax codes batch action which allows the same tax code assignment for a batch of products on the store level.

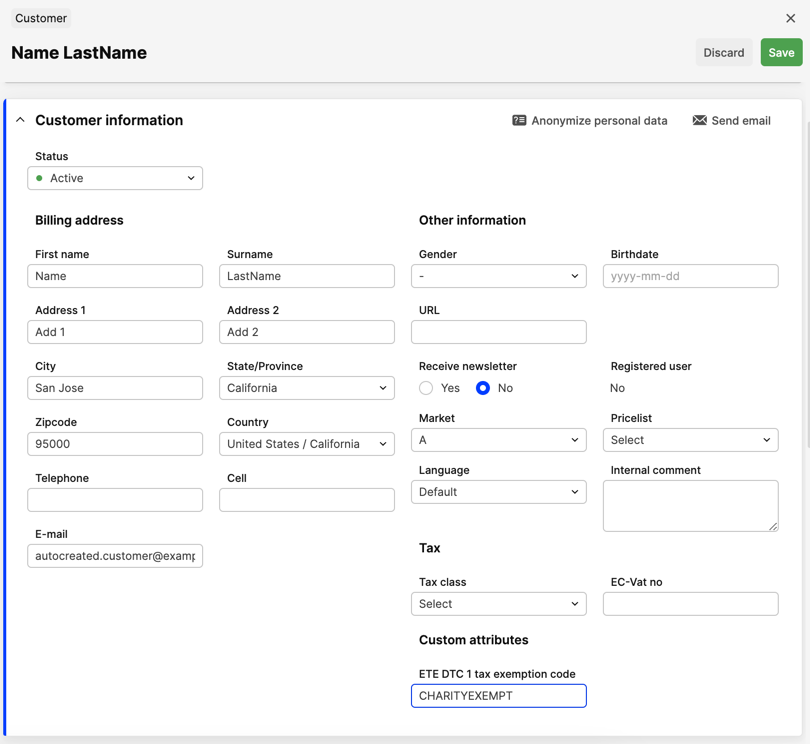

Customer exemption code assignment

There is a possibility to assign the custom exemption code for customer (in Retail) and for account (in Wholesale) to provide more granular tax exemption experience for groups of customers. Entered exemption code will be sent in the payload so external tax service may define if customer/account is eligible for the exemption and apply it.

In case you need to apply personal tax exemptions for certain users, you may check the Customer code definition. However, a customer exemption code can also be used for such purposes.

Flow

At some points in the order lifecycle, it is required by Centra to make calls to the tax engine to calculate the proper tax amount. It may happen either pre-checkout (by filling in the shipping address, changing the number of order items, etc.) or post-checkout (adding/removing items from the order, warehouse changing on allocation, etc.).

In this case, Centra issues the request to ETE with order data (data set may vary depending on the request type) and waits for the response in some format (which also may vary depending on the same request type) to process it and apply the correct tax rules to the order. The way of defining which request and response formats should be used for which action is described below.

Common request concepts

Request type

By design, the plugin will send all tax calculation requests to the same endpoint specified in the plugin settings. However, the request body itself may contain a different set of fields depending on the request type (e.g. order calculation will have the full set of lines, but return calculation may require only some lines from the whole order with partial amount and quantity).

It means that custom ETE must be able to process different payloads and respond in different formats depending on the

action that should be done. To define input and output formats correctly, Centra operates with requestType field value

which indicates action should be done and schema set should be used to process the request properly.

| Request type | Description | Request/response structure |

|---|---|---|

calculateTaxNoCommit | Calculate taxes for orders without the actual commit (it means no saving order data on the ETE side for further reporting to tax authorities). May be used on pre-checkout for the estimated tax calculation. | Order |

calculateDeliveryTaxNoCommit | Calculate taxes for shipments without the actual commit (it means no saving shipment data on the ETE side for further reporting to tax authorities). Used on shipment creation for the estimated tax calculation. | Delivery |

calculateDeliveryTaxAndCommit | Calculate taxes for shipments with the actual commit (with saving shipment data on the ETE side for further reporting to tax authorities). Used on shipment completion for the actual tax calculation. | Delivery |

calculateReturnTaxNoCommit | Calculate taxes for returns without the actual commit (it means no saving return data on the ETE side for further reporting to tax authorities). Used on return creation for the estimated tax calculation. | Return |

calculateReturnTaxAndCommit | Calculate taxes for returns with the actual commit (with saving return data on the ETE side for further reporting to tax authorities). Used on return completion for the actual tax calculation. | Return |

calculateInvoiceTaxNoCommit | Calculate taxes for invoices without the actual commit (it means no saving invoice data on the ETE side for further reporting to tax authorities). Used on invoice creation for the estimated tax calculation. | Invoice |

calculateCreditNoteTaxNoCommit | Calculate taxes for credit notes without the actual commit (it means no saving credit data on the ETE side for further reporting to tax authorities). Used on credit note creation for the estimated tax calculation. | CreditNote |

testTaxEngineConnection | Test the connection with the tax engine. | Test connection |

In case your external tax engine receives some unrecognizable payload (e.g. unknown request type, wrong data for

required fields) or fails to calculate the tax for any reason - it should respond with a verbose

error and non-2xx response code, so Centra will be able to execute a proper fallback to

the internal tax engine calculation.

You may receive the transaction with the committing request type (*AndCommit) and same entity ID a few times.

In this case, your tax engine should handle it properly and update the transaction committed before instead of

responding with an error.

Request signature

The request token is a hash value calculated with the HMAC method and hashing algorithm sha512. It uses the signing

secret string from the plugin settings and JSON-encoded request body to calculate the header value.

To verify the request integrity, you need to construct the hash value in the same way with the same signing secret and compare the calculation result with the income header value.

Please note that you must build the hash value from the original request data. It shouldn't be encoded and decoded back in any way since it may affect the original data (e.g., remove escaping slashes), so the hash calculated from the decoded data will not match the hash received from the request.

Here is the example for header calculation in PHP, but a lot of languages have similar functions (or libraries supported) to calculate the hash value:

private function calculateToken(array $payload, string $signingSecret): string

{

return hash_hmac('sha512', json_encode($payload), $signingSecret);

}

If hashes are equal - it means that the request is valid and data is not corrupted, so it can be processed safely.

Discount handling

Centra uses the approach of basket lines with negative values to handle discounts per line properly. It means that if you have a discount applied on selection, Centra will distribute it across the basket lines automatically and send you discount values per basket line with a negative amount for 2 reasons:

- to keep proper selection total sum calculation;

- to be able to calculate line discount tax value.

The discount line will have the same tax code as the item for which the discount is applied, and the line ID will be

represented as the parent item ID + -discount postfix.

Here is the example, where line 1 is the main line, and line 2 is the discount applied to line 1:

{

"lines": [

{

"id": "133",

"quantity": 1,

"amount": 100,

"taxCode": "code123",

"taxIncluded": false,

"addresses": {

"shipFrom": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 111"

},

"shipTo": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 222"

}

},

"sku": "Product123Variant456Size789",

"description": "TestProduct1",

"productNumber": "Product123"

},

{

"id": "133-discount",

"quantity": 1,

"amount": -10,

"taxCode": "code123",

"taxIncluded": false,

"addresses": {

"shipFrom": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 111"

},

"shipTo": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 222"

}

},

"sku": "Product123Variant456Size789",

"description": "TestProduct1",

"productNumber": "Product123"

}

]

}

For proper tax information processing, Centra expects back the same line ID for both the product line and discount line as it has been sent in the payload. It will help to correctly connect the discount line to its product line.

Additional costs handling

Additional costs (like shipping cost, handling cost, return cost, and return compensation (refund) cost) are using the similar approach to how we handle discounts, but each cost line may appear once in the order/shipment/return lines list. Also, each cost type have its own tax code defined on the plugin level, and some of the cost lines may appear only on some specific entities (e.g. return cost and return compensation cost may be applied for return only).

Additional cost lines will be presented on the payload only in case you define all additional cost tax codes on the

plugin. In case some additional cost code is empty, that additional cost line will not be sent in the lines array.

If applied, the entity-level discount will also be considered as an additional cost and will be sent in a payload as a single line with the entity-level discount tax code. If you want to inherit the item line tax code for discount calculation, you need to use the discount which applied to order items.

{

"lines": [

{

"id": "shipping-delivery-{deliveryId}",

"quantity": 1,

"amount": 5,

"taxCode": "shippingTaxCode",

"taxIncluded": false,

"addresses": {

"shipTo": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 111"

},

"shipFrom": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 222"

}

},

"sku": "shipping",

"description": "Shipping costs"

},

{

"id": "handling-delivery-{deliveryId}",

"quantity": 1,

"amount": 3,

"taxCode": "handlingTaxCode",

"taxIncluded": false,

"addresses": {

"shipTo": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 111"

},

"shipFrom": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 222"

}

},

"sku": "handling",

"description": "Handling costs"

}

]

}

Additional cost line ID constructed by the following schema:

cost type-entity type-entity id

Possible cost types and entity types are explained in the tables below.

| Entity type | Description |

|---|---|

order | This can be met on order calculation |

delivery | This can be met on shipment calculation |

return | This can be met on return calculation |

invoice | This can be met on invoice calculation |

creditNote | This can be met on credit note calculation |

| Additional cost type | Description |

|---|---|

shipping | This applies if there is a shipping cost to tax |

handling | This applies if there is a handling cost to tax |

return-costs | This applies if there is a return cost to tax |

return-compensation | This applies if there is a return compensation (refund) cost to tax |

shipping-d | This can be met if there is a discount applied that affects shipping costs |

handling-d | This can be met if there is a discount applied that affects handling costs |

entity-d | This can be met if there is a discount applied on the entity level |

Some amounts on additional cost lines may be negative, so your tax engine should not consider it as the wrong input. It depends both on the additional cost type and entity type.

For proper tax information processing, Centra expects back the same line ID for each additional cost line as it has been sent in the payload. It will help to correctly connect the additional cost line to the entity.

Customer code definition

The customer code is a string that may be used as a customer identifier for the definition of tax exemption on the external engine side. Centra transfers the customer’s code which you may associate with any kind of exemption in the process of tax calculation on your side, and return the exempted line(s) back to Centra to be processed.

Usually, Centra sends its customer ID as a string, e.g. '77', so you may check which ID the customer has in Centra and

build a connection between the customer and his exemption stored on your ETE side.

However, in the case of anonymous checkout on Centra, there is no customer ID available until the payment stage (it's the moment when we are creating the user in Centra even if the checkout is anonymous). But there are some points in order lifecycle before payment when we want to calculate some taxes, despite the customer is not existing yet.

At that moment, the customer code field will contain Centra basket ID instead of Centra customer ID. Centra basket ID is quite a long and random string, so there are no chances it will match with some customer ID and trigger the exemption on the ETE side.

Company code definition

In case your tax engine supports a multi-company setup, you may want to specify explicitly for which company you want to calculate the tax. For that purpose, Centra has a company code field on plugin level - a string that may be used as a company identifier for your external tax engine. According to the received code, your tax engine may book taxes on behalf of the legal entity you prefer.

Test connection

There is a Test connection button that helps you to check if the connection with your service can be successfully

established. For some out-of-the-box tax engine types (like Avatax) the button works straight away. However, for custom

external tax engine it will require some coding to be done on your side to make the button work since you need to accept

and verify the payload, check request integrity, and maybe do some additional actions on your side (e.g. send some

requests to external tax service under the hood if you use one).

You can check the details of what we are sending to your custom ETE, and which format we expect back, here: Test connection request/response structure.

Request headers

Here is the list of headers we send with the request, all of them may be used for logging purposes and reported to support for debugging purposes too.

| Header | Type | Comment |

|---|---|---|

X-Client-Id | string | Client instance ID, e.g. boilerplate-dev |

X-Request-Id | string | Centra request ID, e.g. 1_1b4591cbd04624e5bce7b1d530adaabe |

X-Correlation-Id | string | Centra correlation ID, e.g. centra_1_1b4591cbd04624e5bce7b1d530adaabe |

X-Request-Signature | string | Contains the request signature string constructed with help of signing secret provided as a plugin setting. May be used to verify the origin of the request and the integrity of the request’s body. See more on Request signature |

User-Agent | string | Contains information regarding the Centra version used on request. Example: Centra (https://centra.com), version: v3.33.1 |

Error response

Error response structure is common for all entities, so it is listed only once here.

In case of an error, the response should have a non-2xx response code and a reasonable message for debugging purposes.

{

"error": {

"message": "Unable to calculate tax."

}

}

| Field | Type | Comment |

|---|---|---|

message | string | A message which indicates the error |

Order request/response structure

Request

Headers

See Request headers.

Body

{

"data": {

"requestType": "calculateTaxNoCommit",

"taxEngine": "custom",

"entityId": "12681d9bab682309c0fe60102d86d5d6",

"customerCode": "50b9577bbe8f9",

"transactionDate": "2023-04-07",

"transactionDateTime": "2023-04-07T01:12:20+00:00",

"orderCreationDateTime": "2023-04-07T01:12:20+00:00",

"currencyCode": "USD",

"lines": [

{

"id": "133",

"quantity": 1,

"amount": 100,

"taxCode": "code123",

"taxIncluded": false,

"addresses": {

"shipFrom": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 111"

},

"shipTo": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 222"

}

},

"sku": "Product123Variant456Size789",

"description": "TestProduct1",

"productNumber": "Product123"

},

{

"id": "134",

"quantity": 1,

"amount": 200,

"taxCode": "code456",

"taxIncluded": false,

"addresses": {

"shipFrom": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 111"

},

"shipTo": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 222"

}

},

"sku": "Product456Variant789Size012",

"description": "TestProduct2",

"productNumber": "Product456"

}

]

}

}

Order structure

| Field | Type | Comment |

|---|---|---|

requestType | string | The request type indicates which type of calculation should be done on the ETE side, always equals to calculateTaxNoCommit for orders |

taxEngine | string | Always equals custom |

entityId | string | Entity ID, here represents Centra basket ID |

customerCode | string | Customer code, required primarily for tax exempt identification. For value explanation, see more on Customer code definition |

companyCode (optional) | string | Company code, used for transaction assigning to specific company in case of multi-company setup. See more on Company code definition |

customerExemptionCode (optional) | string | Customer exemption code, used for tax exempt identification. See more on Customer exemption code assignment |

transactionDate | string, in YYYY-MM-DD format | Calculation date (current date by default but also may take past values, e.g. order creation date) |

transactionDateTime | string, in YYYY-MM-DDThh:mm:ss±hh:mm format | Calculation date with timestamp and timezone |

orderCreationDateTime (optional) | string, in YYYY-MM-DDThh:mm:ss±hh:mm format | Order creation date with timestamp and timezone |

currencyCode | string, in ISO 4217 currency format | Currency used for this calculation |

lines | array | Order lines for calculation |

Line structure

| Field | Type | Comment |

|---|---|---|

id | string or integer | Order line ID |

quantity | integer | Quantity of items ordered |

amount | float | The sum of items' prices. Amount value may be negative in some cases (see more on Discount handling or Additional costs handling) |

taxCode | string | Tax identifier, used to define the proper tax rate |

taxIncluded | boolean | Flag to indicate if line amount includes the tax value |

addresses | object of addresses | Shipping addresses information. The object may contain either shipFrom or shipTo address or both at the same time |

sku (optional) | string | Full item SKU (product + variant + size) |

description (optional) | string | Item description |

productNumber (optional) | string | a.k.a. Product SKU |

Address structure

| Field | Type | Comment |

|---|---|---|

country | string | Country ISO code (2 symbols) |

postalCode (optional) | string | Postal code |

state (optional) | string | State ISO code (2 symbols) |

city (optional) | string | City |

line1 (optional) | string | Address line 1 |

line2 (optional) | string | Address line 2 |

Response

Success

{

"data": {

"transactionId": "uniq-trans-id-123",

"transactionType": "custom-operation-type-string",

"totalTax": 19.18,

"totalDiscount": null,

"lines": [

{

"id": "133",

"quantity": 1,

"amount": 100,

"taxableAmount": 96.5,

"tax": 6.39,

"taxIncluded": false,

"rules": [

{

"taxId": "32b71e721c4fe0d80c922ed0e0badd3c",

"taxName": "NJ STATE TAX",

"taxableAmount": 96.5,

"rate": 0.06625,

"tax": 6.39

}

]

},

{

"id": "134",

"quantity": 1,

"amount": 200,

"taxableAmount": 193,

"tax": 12.79,

"taxIncluded": false,

"rules": [

{

"taxId": "32b71e721c4fe0d80c922ed0e0badd3c",

"taxName": "NJ STATE TAX",

"taxableAmount": 193,

"rate": 0.06625,

"tax": 12.79

}

]

}

]

}

}

Order structure

| Field | Type | Comment |

|---|---|---|

transactionId | string | Calculation result ID assigned by external tax calculator |

transactionType | string | Type of calculated action assigned by external tax calculator. May be any string that will help you to indicate which operation has been done on your tax engine side (like order/delivery/return/invoice/credit note calculation, committed or not committed). You can either specify your own type or send back the type you received in the request |

totalTax | float | Total tax value |

totalDiscount (optional) | float or null | Total discount value |

lines | array | Tax info per order line |

Line structure

| Field | Type | Comment |

|---|---|---|

id | string | Order line ID |

quantity | integer | Quantity of items ordered |

amount | float | The sum of items' prices |

taxableAmount | float | Line amount value that should be taxed (may not equal the full line amount) |

tax | float | Calculated tax value for all line items |

taxIncluded | boolean | Flag to indicate if line amount includes tax value |

rules | array | An array of tax rules applied to the current line |

Rule structure

| Field | Type | Comment |

|---|---|---|

taxId | string | Tax rule identifier. Should be the same for equal rule types for proper grouping on the Centra side |

taxName | string | Name of the tax rule |

taxableAmount | float | Line amount value that should be taxed by current rule (may not equal the full line amount) |

rate | float | Tax rate value, absolute (should be contained between 0 and 1) |

tax | float | Calculated tax value for the current line and rule |

Error

See Error response.

Delivery request/response structure

Request

Headers

See Request headers.

Body

{

"data": {

"requestType": "calculateDeliveryTaxNoCommit",

"taxEngine": "custom",

"entityId": "31-1",

"customerCode": "100",

"transactionDate": "2023-04-15",

"transactionDateTime": "2023-04-15T12:00:10+01:00",

"orderCreationDateTime": "2023-04-15T10:00:00+01:00",

"currencyCode": "USD",

"lines": [

{

"id": "1122",

"quantity": 1,

"amount": 100,

"taxCode": "code123",

"taxIncluded": false,

"addresses": {

"shipFrom": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 111"

},

"shipTo": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 222"

}

},

"sku": "Product123Variant456Size789",

"description": "TestProduct1",

"productNumber": "Product123"

},

{

"id": "1123",

"quantity": 1,

"amount": 200,

"taxCode": "code456",

"taxIncluded": false,

"addresses": {

"shipFrom": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 111"

},

"shipTo": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 222"

}

},

"sku": "Product456Variant789Size012",

"description": "TestProduct2",

"productNumber": "Product456"

}

]

}

}

Delivery structure

| Field | Type | Comment |

|---|---|---|

requestType | string, one of: calculateDeliveryTaxNoCommit, calculateDeliveryTaxAndCommit | The request type indicates which type of calculation should be done on the ETE side |

taxEngine | string | Always equals custom |

entityId | string | Entity ID, here represents Centra shipment ID |

customerCode | string | Customer code, required primarily for tax exempt identification. For value explanation, see more on Customer code definition |

companyCode (optional) | string | Company code, used for transaction assigning to specific company in case of multi-company setup. See more on Company code definition |

customerExemptionCode (optional) | string | Customer exemption code, used for tax exempt identification. See more on Customer exemption code assignment |

transactionDate | string, in YYYY-MM-DD format | Calculation date (current date by default but also may take past values, e.g. shipment creation date or shipment completion date) |

transactionDateTime | string, in YYYY-MM-DDThh:mm:ss±hh:mm format | Calculation date with timestamp and timezone |

orderCreationDateTime (optional) | string, in YYYY-MM-DDThh:mm:ss±hh:mm format | Order creation date with timestamp and timezone |

currencyCode | string, in ISO 4217 currency format | Currency used for this calculation |

lines | array | Shipment lines for calculation |

Line structure

| Field | Type | Comment |

|---|---|---|

id | string or integer | Shipment line ID |

quantity | integer | Quantity of items shipped |

amount | float | The sum of items' prices. Amount value may be negative in some cases (see more on Discount handling or Additional costs handling) |

taxCode | string | Tax identifier, used to define the proper tax rate |

taxIncluded | boolean | Flag to indicate if line amount includes the tax value |

addresses | object of addresses | Shipping addresses information. The object may contain either shipFrom or shipTo address or both at the same time |

sku (optional) | string | Full item SKU (product + variant + size) |

description (optional) | string | Item description |

productNumber (optional) | string | a.k.a. Product SKU |

Address structure

| Field | Type | Comment |

|---|---|---|

country | string | Country ISO code (2 symbols) |

postalCode (optional) | string | Postal code |

state (optional) | string | State ISO code (2 symbols) |

city (optional) | string | City |

line1 (optional) | string | Address line 1 |

line2 (optional) | string | Address line 2 |

Response

Success

{

"data": {

"transactionId": "uniq-trans-id-456",

"transactionType": "delivery-custom-operation-type-string",

"totalTax": 19.18,

"totalDiscount": null,

"lines": [

{

"id": "1122",

"quantity": 1,

"amount": 100,

"taxableAmount": 96.5,

"tax": 6.39,

"taxIncluded": false,

"rules": [

{

"taxId": "32b71e721c4fe0d80c922ed0e0badd3c",

"taxName": "NJ STATE TAX",

"taxableAmount": 96.5,

"rate": 0.06625,

"tax": 6.39

}

]

},

{

"id": "1123",

"quantity": 1,

"amount": 200,

"taxableAmount": 193,

"tax": 12.79,

"taxIncluded": false,

"rules": [

{

"taxId": "32b71e721c4fe0d80c922ed0e0badd3c",

"taxName": "NJ STATE TAX",

"taxableAmount": 193,

"rate": 0.06625,

"tax": 12.79

}

]

}

]

}

}

Delivery structure

| Field | Type | Comment |

|---|---|---|

transactionId | string | Calculation result ID assigned by external tax calculator |

transactionType | string | Type of calculated action assigned by external tax calculator. May be any string that will help you to indicate which operation has been done on your tax engine side (like order/delivery/return/invoice/credit note calculation, committed or not committed). You can either specify your own type or send back the type you received in the request |

totalTax | float | Total tax value |

totalDiscount (optional) | float or null | Total discount value |

lines | array | Tax info per shipment line |

Line structure

| Field | Type | Comment |

|---|---|---|

id | string | Shipment line ID |

quantity | integer | Quantity of items shipped |

amount | float | The sum of items' prices |

taxableAmount | float | Line amount value that should be taxed (may not equal the full line amount) |

tax | float | Calculated tax value for all line items |

taxIncluded | boolean | Flag to indicate if line amount includes tax value |

rules | array | An array of tax rules applied to the current line |

Rule structure

| Field | Type | Comment |

|---|---|---|

taxId | string | Tax rule identifier. Should be the same for equal rule types for proper grouping on the Centra side |

taxName | string | Name of the tax rule |

taxableAmount | float | Line amount value that should be taxed by current rule (may not equal the full line amount) |

rate | float | Tax rate value, absolute (should be contained between 0 and 1) |

tax | float | Calculated tax value for the current line and rule |

Error

See Error response.

Return request/response structure

Request

Headers

See Request headers.

Body

{

"data": {

"requestType": "calculateReturnTaxAndCommit",

"taxEngine": "custom",

"entityId": "31-1-2",

"parentEntityId": "31-1",

"customerCode": "100",

"transactionDate": "2023-04-17",

"transactionDateTime": "2023-04-17T07:21:00+00:00",

"taxationDate": "2023-04-15",

"taxationDateTime": "2023-04-15T01:20:19+01:00",

"orderCreationDateTime": "2023-04-15T00:01:19+01:00",

"currencyCode": "USD",

"lines": [

{

"id": "15",

"quantity": 1,

"amount": -100,

"taxCode": "code123",

"taxIncluded": false,

"addresses": {

"shipFrom": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 111"

},

"shipTo": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 222"

}

},

"sku": "Product123Variant456Size789",

"description": "TestProduct1",

"productNumber": "Product123"

},

{

"id": "16",

"quantity": 1,

"amount": -200,

"taxCode": "code456",

"taxIncluded": false,

"addresses": {

"shipFrom": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 111"

},

"shipTo": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 222"

}

},

"sku": "Product456Variant789Size012",

"description": "TestProduct2",

"productNumber": "Product456"

}

]

}

}

Return structure

| Field | Type | Comment |

|---|---|---|

requestType | string, one of: calculateReturnTaxNoCommit, calculateReturnTaxAndCommit | The request type indicates which type of calculation should be done on the ETE side |

taxEngine | string | Always equals custom |

entityId | string | Entity ID, here represents Centra return ID |

parentEntityId | string | Parent entity ID, here represents Centra shipment ID |

customerCode | string | Customer code, required primarily for tax exempt identification. For value explanation, see more on Customer code definition |

companyCode (optional) | string | Company code, used for transaction assigning to specific company in case of multi-company setup. See more on Company code definition |

customerExemptionCode (optional) | string | Customer exemption code, used for tax exempt identification. See more on Customer exemption code assignment |

transactionDate | string, in YYYY-MM-DD format | Calculation date (current date by default but also may take past values, e.g. return creation date or return completion date) |

transactionDateTime | string, in YYYY-MM-DDThh:mm:ss±hh:mm format | Calculation date with timestamp and timezone |

taxationDate | string, in YYYY-MM-DD format | Taxation date (date when the shipment has been completed, required for proper tax value calculation for return) |

taxationDateTime | string, in YYYY-MM-DDThh:mm:ss±hh:mm format | Taxation date with timestamp and timezone |

orderCreationDateTime (optional) | string, in YYYY-MM-DDThh:mm:ss±hh:mm format | Order creation date with timestamp and timezone |

currencyCode | string, in ISO 4217 currency format | Currency used for this calculation |

lines | array | Return lines for calculation |

taxationDate should be used in tax calculation for items that are returned to make sure the same tax rules and rates

are applied, and that refund value will not be undertaxed or overtaxed. transactionDate here serves as the actual date

when the return has been initiated.

Line structure

| Field | Type | Comment |

|---|---|---|

id | string or integer | Return line ID |

quantity | integer | Quantity of items returned |

amount | float | The sum of items' prices. Amount value may be positive, e.g. because of discount returns (see more on Discount handling) or additional cost application (see more on Additional costs handling) |

taxCode | string | Tax identifier, used to define the proper tax rate |

taxIncluded | boolean | Flag to indicate if line amount includes the tax value |

addresses | object of addresses | Shipping addresses information. The object may contain either shipFrom or shipTo address or both at the same time |

sku (optional) | string | Full item SKU (product + variant + size) |

description (optional) | string | Item description |

productNumber (optional) | string | a.k.a. Product SKU |

Address structure

| Field | Type | Comment |

|---|---|---|

country | string | Country ISO code (2 symbols) |

postalCode (optional) | string | Postal code |

state (optional) | string | State ISO code (2 symbols) |

city (optional) | string | City |

line1 (optional) | string | Address line 1 |

line2 (optional) | string | Address line 2 |

Response

Success

{

"data": {

"transactionId": "uniq-trans-id-789",

"transactionType": "return-custom-operation-type-string",

"totalTax": -19.18,

"totalDiscount": null,

"lines": [

{

"id": "15",

"quantity": 1,

"amount": -100,

"taxableAmount": -96.5,

"tax": -6.39,

"taxIncluded": false,

"rules": [

{

"taxId": "32b71e721c4fe0d80c922ed0e0badd3c",

"taxName": "NJ STATE TAX",

"taxableAmount": -96.5,

"rate": 0.06625,

"tax": -6.39

}

]

},

{

"id": "16",

"quantity": 1,

"amount": -200,

"taxableAmount": -193,

"tax": -12.79,

"taxIncluded": false,

"rules": [

{

"taxId": "32b71e721c4fe0d80c922ed0e0badd3c",

"taxName": "NJ STATE TAX",

"taxableAmount": -193,

"rate": 0.06625,

"tax": -12.79

}

]

}

]

}

}

Return structure

| Field | Type | Comment |

|---|---|---|

transactionId | string | Calculation result ID assigned by external tax calculator |

transactionType | string | Type of calculated action assigned by external tax calculator. May be any string that will help you to indicate which operation has been done on your tax engine side (like order/delivery/return/invoice/credit note calculation, committed or not committed). You can either specify your own type or send back the type you received in the request |

totalTax | float | Total tax value |

totalDiscount (optional) | float or null | Total discount value |

lines | array | Tax info per return line |

Line structure

| Field | Type | Comment |

|---|---|---|

id | string | Return line ID |

quantity | integer | Quantity of items returned |

amount | float | The sum of items' prices |

taxableAmount | float | Line amount value that should be taxed (may not equal the full line amount) |

tax | float | Calculated tax value for all line items |

taxIncluded | boolean | Flag to indicate if line amount includes tax value |

rules | array | An array of tax rules applied to the current line |

Rule structure

| Field | Type | Comment |

|---|---|---|

taxId | string | Tax rule identifier. Should be the same for equal rule types for proper grouping on the Centra side |

taxName | string | Name of the tax rule |

taxableAmount | float | Line amount value that should be taxed by current rule (may not equal the full line amount) |

rate | float | Tax rate value, absolute (should be contained between 0 and 1) |

tax | float | Calculated tax value for the current line and rule |

Error

See Error response.

Invoice request/response structure

Request

Headers

See Request headers.

Body

{

"data": {

"requestType": "calculateInvoiceTaxNoCommit",

"taxEngine": "custom",

"entityId": "26",

"customerCode": "100",

"transactionDate": "2024-09-23",

"transactionDateTime": "2024-09-23T15:10:12+01:00",

"currencyCode": "USD",

"lines": [

{

"id": "52",

"quantity": 1,

"amount": 100,

"taxCode": "code123",

"taxIncluded": false,

"addresses": {

"shipFrom": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 111"

},

"shipTo": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 222"

}

},

"sku": "Product123Variant456Size789",

"description": "TestProduct1",

"productNumber": "Product123"

},

{

"id": "53",

"quantity": 1,

"amount": 200,

"taxCode": "code456",

"taxIncluded": false,

"addresses": {

"shipFrom": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 111"

},

"shipTo": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 222"

}

},

"sku": "Product456Variant789Size012",

"description": "TestProduct2",

"productNumber": "Product456"

}

]

}

}

Invoice structure

| Field | Type | Comment |

|---|---|---|

requestType | string, one of: calculateInvoiceTaxNoCommit | The request type indicates which type of calculation should be done on the ETE side |

taxEngine | string | Always equals custom |

entityId | string | Entity ID, here represents Centra invoice ID |

customerCode | string | Customer code, required primarily for tax exempt identification. For value explanation, see more on Customer code definition |

companyCode (optional) | string | Company code, used for transaction assigning to specific company in case of multi-company setup. See more on Company code definition |

customerExemptionCode (optional) | string | Customer exemption code, used for tax exempt identification. See more on Customer exemption code assignment |

transactionDate | string, in YYYY-MM-DD format | Calculation date (current date by default but also may take past values, e.g. invoice creation date) |

transactionDateTime | string, in YYYY-MM-DDThh:mm:ss±hh:mm format | Calculation date with timestamp and timezone |

currencyCode | string, in ISO 4217 currency format | Currency used for this calculation |

lines | array | Invoice lines for calculation |

Line structure

| Field | Type | Comment |

|---|---|---|

id | string or integer | Invoice line ID |

quantity | integer | Quantity of items invoiced |

amount | float | The sum of items' prices. Amount value may be negative in some cases (see more on Discount handling or Additional costs handling) |

taxCode | string | Tax identifier, used to define the proper tax rate |

taxIncluded | boolean | Flag to indicate if line amount includes the tax value |

addresses | object of addresses | Shipping addresses information. The object may contain either shipFrom or shipTo address or both at the same time |

sku (optional) | string | Full item SKU (product + variant + size) |

description (optional) | string | Item description |

productNumber (optional) | string | a.k.a. Product SKU |

Address structure

| Field | Type | Comment |

|---|---|---|

country | string | Country ISO code (2 symbols) |

postalCode (optional) | string | Postal code |

state (optional) | string | State ISO code (2 symbols) |

city (optional) | string | City |

line1 (optional) | string | Address line 1 |

line2 (optional) | string | Address line 2 |

Response

Success

{

"data": {

"transactionId": "uniq-trans-id-012",

"transactionType": "invoice-custom-operation-type-string",

"totalTax": 19.18,

"totalDiscount": null,

"lines": [

{

"id": "52",

"quantity": 1,

"amount": 100,

"taxableAmount": 96.5,

"tax": 6.39,

"taxIncluded": false,

"rules": [

{

"taxId": "32b71e721c4fe0d80c922ed0e0badd3c",

"taxName": "NJ STATE TAX",

"taxableAmount": 96.5,

"rate": 0.06625,

"tax": 6.39

}

]

},

{

"id": "53",

"quantity": 1,

"amount": 200,

"taxableAmount": 193,

"tax": 12.79,

"taxIncluded": false,

"rules": [

{

"taxId": "32b71e721c4fe0d80c922ed0e0badd3c",

"taxName": "NJ STATE TAX",

"taxableAmount": 193,

"rate": 0.06625,

"tax": 12.79

}

]

}

]

}

}

Invoice structure

| Field | Type | Comment |

|---|---|---|

transactionId | string | Calculation result ID assigned by external tax calculator |

transactionType | string | Type of calculated action assigned by external tax calculator. May be any string that will help you to indicate which operation has been done on your tax engine side (like order/delivery/return/invoice/credit note calculation, committed or not committed). You can either specify your own type or send back the type you received in the request |

totalTax | float | Total tax value |

totalDiscount (optional) | float or null | Total discount value |

lines | array | Tax info per shipment line |

Line structure

| Field | Type | Comment |

|---|---|---|

id | string | Invoice line ID |

quantity | integer | Quantity of items invoiced |

amount | float | The sum of items' prices |

taxableAmount | float | Line amount value that should be taxed (may not equal the full line amount) |

tax | float | Calculated tax value for all line items |

taxIncluded | boolean | Flag to indicate if line amount includes tax value |

rules | array | An array of tax rules applied to the current line |

Rule structure

| Field | Type | Comment |

|---|---|---|

taxId | string | Tax rule identifier. Should be the same for equal rule types for proper grouping on the Centra side |

taxName | string | Name of the tax rule |

taxableAmount | float | Line amount value that should be taxed by current rule (may not equal the full line amount) |

rate | float | Tax rate value, absolute (should be contained between 0 and 1) |

tax | float | Calculated tax value for the current line and rule |

Error

See Error response.

Credit note request/response structure

Request

Headers

See Request headers.

Body

{

"data": {

"requestType": "calculateCreditNoteTaxNoCommit",

"taxEngine": "custom",

"entityId": "27",

"customerCode": "100",

"transactionDate": "2024-09-23",

"transactionDateTime": "2024-09-23T01:20:19+00:00",

"taxationDate": "2024-09-20",

"taxationDateTime": "2024-09-20T10:20:19+00:00",

"currencyCode": "USD",

"lines": [

{

"id": "54",

"quantity": 1,

"amount": -100,

"taxCode": "code123",

"taxIncluded": false,

"addresses": {

"shipFrom": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 111"

},

"shipTo": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 222"

}

},

"sku": "Product123Variant456Size789",

"description": "TestProduct1",

"productNumber": "Product123"

},

{

"id": "55",

"quantity": 1,

"amount": -200,

"taxCode": "code456",

"taxIncluded": false,

"addresses": {

"shipFrom": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 111"

},

"shipTo": {

"country": "US",

"postalCode": "07936",

"state": "NJ",

"city": "East Hanover",

"line1": "27 Merry Ln",

"line2": "apt. 222"

}

},

"sku": "Product456Variant789Size012",

"description": "TestProduct2",

"productNumber": "Product456"

}

]

}

}

Credit note structure

| Field | Type | Comment |

|---|---|---|

requestType | string, one of: calculateCreditNoteTaxNoCommit | The request type indicates which type of calculation should be done on the ETE side |

taxEngine | string | Always equals custom |

entityId | string | Entity ID, here represents Centra credit note ID |

customerCode | string | Customer code, required primarily for tax exempt identification. For value explanation, see more on Customer code definition |

companyCode (optional) | string | Company code, used for transaction assigning to specific company in case of multi-company setup. See more on Company code definition |

customerExemptionCode (optional) | string | Customer exemption code, used for tax exempt identification. See more on Customer exemption code assignment |

transactionDate | string, in YYYY-MM-DD format | Calculation date (current date by default but also may take past values, e.g. credit note creation date) |

transactionDateTime | string, in YYYY-MM-DDThh:mm:ss±hh:mm format | Calculation date with timestamp and timezone |

taxationDate | string, in YYYY-MM-DD format | Taxation date (date when the the base invoice has been calculated, required for proper tax value calculation for credit note) |

taxationDateTime | string, in YYYY-MM-DDThh:mm:ss±hh:mm format | Taxation date with timestamp and timezone |

currencyCode | string, in ISO 4217 currency format | Currency used for this calculation |

lines | array | Credit note lines for calculation |

taxationDate should be used in tax calculation for items that are listed in a credit note to make sure the same tax

rules and rates are applied as for the related invoice, and that credit note values will not be undertaxed or overtaxed.

transactionDate here serves as the actual date when the credit note has been created.

Line structure

| Field | Type | Comment |

|---|---|---|

id | string or integer | Credit note line ID |

quantity | integer | Quantity of items on credit note line |

amount | float | The sum of items' prices. Amount value may be positive, e.g. because of discount returns (see more on Discount handling) or additional cost application (see more on Additional costs handling) |

taxCode | string | Tax identifier, used to define the proper tax rate |

taxIncluded | boolean | Flag to indicate if line amount includes the tax value |

addresses | object of addresses | Shipping addresses information. The object may contain either shipFrom or shipTo address or both at the same time |

sku (optional) | string | Full item SKU (product + variant + size) |

description (optional) | string | Item description |

productNumber (optional) | string | a.k.a. Product SKU |

Address structure

| Field | Type | Comment |

|---|---|---|

country | string | Country ISO code (2 symbols) |

postalCode (optional) | string | Postal code |

state (optional) | string | State ISO code (2 symbols) |

city (optional) | string | City |

line1 (optional) | string | Address line 1 |

line2 (optional) | string | Address line 2 |

Response

Success

{

"data": {

"transactionId": "uniq-trans-id-345",

"transactionType": "credit-note-custom-operation-type-string",

"totalTax": -19.18,

"totalDiscount": null,

"lines": [

{

"id": "54",

"quantity": 1,

"amount": -100,

"taxableAmount": -96.5,

"tax": -6.39,

"taxIncluded": false,

"rules": [

{

"taxId": "32b71e721c4fe0d80c922ed0e0badd3c",

"taxName": "NJ STATE TAX",

"taxableAmount": -96.5,

"rate": 0.06625,

"tax": -6.39

}

]

},

{

"id": "55",

"quantity": 1,

"amount": -200,

"taxableAmount": -193,

"tax": -12.79,

"taxIncluded": false,

"rules": [

{

"taxId": "32b71e721c4fe0d80c922ed0e0badd3c",

"taxName": "NJ STATE TAX",

"taxableAmount": -193,

"rate": 0.06625,

"tax": -12.79

}

]

}

]

}

}

Credit note structure

| Field | Type | Comment |

|---|---|---|

transactionId | string | Calculation result ID assigned by external tax calculator |

transactionType | string | Type of calculated action assigned by external tax calculator. May be any string that will help you to indicate which operation has been done on your tax engine side (like order/delivery/return/invoice/credit note calculation, committed or not committed). You can either specify your own type or send back the type you received in the request |

totalTax | float | Total tax value |

totalDiscount (optional) | float or null | Total discount value |

lines | array | Tax info per return line |

Line structure

| Field | Type | Comment |

|---|---|---|

id | string | Credit note line ID |

quantity | integer | Quantity of items on credit note line |

amount | float | The sum of items' prices |

taxableAmount | float | Line amount value that should be taxed (may not equal the full line amount) |

tax | float | Calculated tax value for all line items |

taxIncluded | boolean | Flag to indicate if line amount includes tax value |

rules | array | An array of tax rules applied to the current line |

Rule structure

| Field | Type | Comment |

|---|---|---|

taxId | string | Tax rule identifier. Should be the same for equal rule types for proper grouping on the Centra side |

taxName | string | Name of the tax rule |

taxableAmount | float | Line amount value that should be taxed by current rule (may not equal the full line amount) |

rate | float | Tax rate value, absolute (should be contained between 0 and 1) |

tax | float | Calculated tax value for the current line and rule |

Error

See Error response.

Test connection request/response structure

Request

Headers

See Request headers.

Body

{

"data": {

"requestType": "testTaxEngineConnection",

"taxEngine": "custom"

}

}

Test connection request structure

| Field | Type | Comment |

|---|---|---|

requestType | string | Always equals to testTaxEngineConnection |

taxEngine | string | Always equals custom |

Response

Success

A successful request body will be ignored, so it's enough for your ETE to respond with a 2xx response code with no or

empty body.

{}

Error

See Error response.